The Market Operations Index values, including 5708464174 and 5714097807, present crucial data points for assessing market dynamics. These figures reflect investor sentiment and market performance, influencing strategic decisions. Analysts can leverage these metrics to forecast trends and identify potential shifts in the financial landscape. Understanding the nuances behind these numbers could reveal deeper insights into market behavior. What implications might these fluctuations hold for future investment strategies?

Understanding the Market Operations Index Values

As the financial landscape evolves, understanding the Market Operations Index (MOI) values becomes essential for analysts and investors alike.

The MOI serves as a critical barometer for market value, reflecting index fluctuations that inform strategic decision-making.

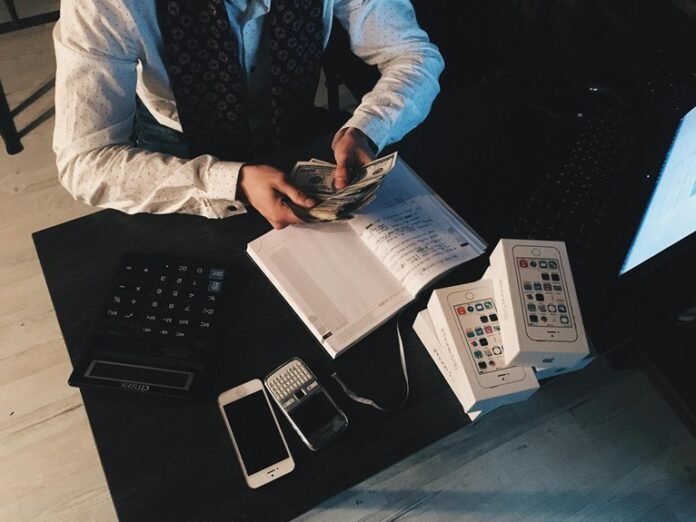

Analyzing the Impact of Market Operations on Investment Strategies

How do market operations influence the formulation of investment strategies?

Market operations significantly affect investment risk and market volatility, guiding investors in decision-making.

By analyzing market trends and operational data, investors can strategically allocate resources, mitigating risks associated with unpredictable market fluctuations.

This analytical approach empowers investors to navigate complexities, ultimately fostering a more resilient investment portfolio aligned with their financial objectives.

Predicting Market Trends Using the Operations Index

While market operations are often viewed through the lens of immediate financial outcomes, the Operations Index provides a critical framework for forecasting long-term market trends.

Conclusion

In the intricate dance of market operations, the index values resemble a compass guiding investors through uncharted waters. Just as seasoned sailors rely on navigational tools to avoid storms, investors utilize these indicators to steer clear of financial turbulence. The recent fluctuations in values—like the sudden shift in wind direction—highlight the necessity for vigilance and adaptability in investment strategies. Understanding these metrics not only illuminates current market health but also prepares investors for the unpredictable currents ahead.